One of the most popular real estate states is Florida. Whether you as of now dwell in Florida and need to purchase another home, or you expect to move to Florida to begin carrying on with your dream life by the ocean side, there are a few things you ought to be aware of purchasing a property in Florida during Florida’s real estate boom.

The temperature in Florida isn’t the only hot thing. Historically, the Florida real estate market has been one of the most rewarding investment areas. There are numerous reasons to believe that buying Florida investment homes is a worthwhile experience. For example, the state provides a profitable return on investment for property owners. This means that while you may pay more for your chosen property upfront, your investment will pay off.

This is mostly due to the area’s status as one of the world’s most well-known tourist destinations and the weather and attractions available to tourists and sunseekers. If you want to invest in Florida real estate, now is the best moment to do it. But before buying a house in Florida, read this article.

Dos of Buying a House During Florida’s Real Estate Boom

1. Check Your Financial History

The first step in buying a new house is to review your financial history. Lenders will dig deep into your finances over the last few years when deciding whether or not to give you a mortgage. Before you begin this process, it’s preferable that you have a clear image of your financial situation.

Taking a glance at your credit score is the easiest approach to get a sense of your overall financial health.

You can check your credit score through your bank; however, you should avoid using credit score websites unless they guarantee that the check will not affect your score. The better your credit score is, the better your chances are of getting a loan.

2. Know About Insurance Policies

Florida is gorgeous with miles of coastline splendor, but don’t let the picture-perfect weather fool you into thinking it’s immune to storms. Floods and hurricanes are prevalent in Florida, and the best way to prepare for them is to acquire a home built to resist high winds and purchase the appropriate homeowner’s insurance. Don’t forget to include additional insurance fees in your final budget when calculating how much you can spend each month on your mortgage. Because it was built to the most recent building code restrictions, insurance is usually less if you buy a home built in 2002 or newer. Calling insurance providers and inquiring about homes you’re interested in is always a good idea. If you are deciding between two properties, any insurance agency should be pleased to offer you a quick cost comparison.

3. Consider The Location

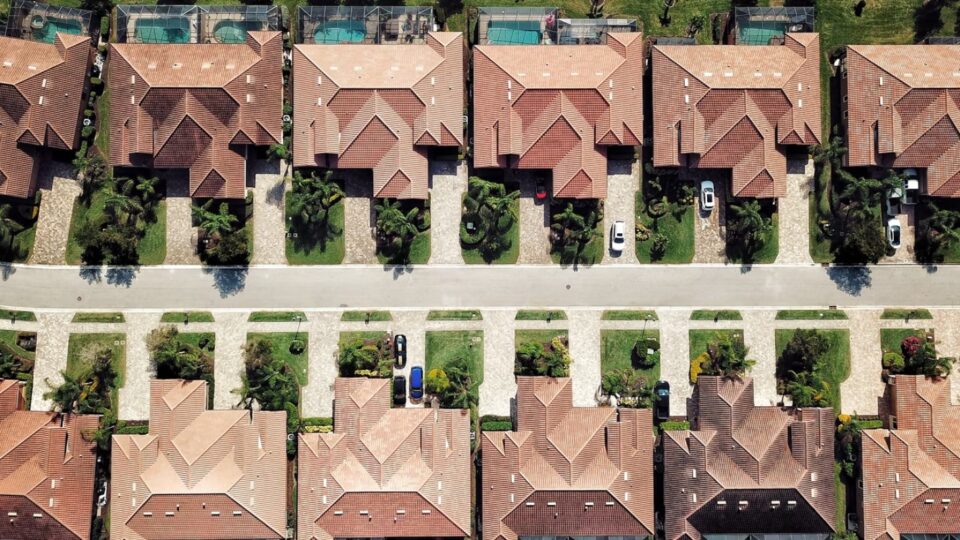

It’s all too easy to get caught up with the property. While the property itself is obviously the most crucial factor to evaluate, you must also consider the location. In Florida, there are numerous resorts and neighborhoods, each with its own unique beauty and benefits. It’s critical to choose intelligently because your area will decide your long-term financial potential.

Consider your rental plan if you want to buy an investment property in Florida. Consider regions in Central Florida if you want to be close to popular tourist spots. Don’t forget about personal delight — it should still be a place you enjoy visiting.

4. Save For Down Payment

What is the maximum amount of home you can afford? More than your desired mortgage payment should be considered. Property taxes, homeowner’s insurance, and any homeowner’s association fees will all be included in your monthly payment. You must also account for your down payment and total closing costs, which must be paid in advance. Fortunately, there are tools available online and at financial institutions that may assist you in determining the home with the price and annual charges that you can easily afford without going over your budget.

Don’ts of Buying a House During Florida’s Real Estate Boom

5. Don’t Forget About Property Maintenance

Regarding Florida investment properties, topics like property care and management are important to consider. Will you handle this solo, or will you enlist the help of a third party to shoulder some of the burdens? Whether you choose to live in Florida or not will be the deciding factor.

If you want to rent out your investment property to renters, you will be responsible for answering any questions or concerns they may have throughout their tenure. It also implies you’ll be in charge of keeping the property in good working order. This is especially true for residences with private or shared swimming pools. Similar to timeshare properties, maintenance fees are one of the things that property owners should be wary of. A lot of timeshare property owners get caught up with high maintenance fees and ended up looking for answers on how to sell a time share.

6. Don’t Miss Out On Experts

With so many variables to consider when buying a house in Florida, it’s critical to hire a skilled real estate advisor. One of the most crucial decisions you’ll make on your journey is who you hire to assist you in your search for the perfect home. You can successfully traverse the Florida real estate market and find the perfect property for you with the help of the right partner.

In your chase after another home, an expert and experienced realtor is an extraordinary resource. A realtor is probably the best individual to give you private data about your inquiry region on the off chance that you’re new to the area or Florida overall. Their market information, assets, discussion abilities, and land management skills can assist you with saving time, cash, and hassle. Choose a reputable realtor with a track record of facilitating house transactions in the location you choose.

Conclusion

Congratulations! Purchasing your first home in Florida is a significant achievement in your life, and you should be proud of yourself. Homeownership is a rewarding experience, and you should savor every moment of the excitement and joy that comes with purchasing your first house in Florida. Visit Central Florida for thrills at theme parks or a refreshing drink made from a fresh coconut. You’re now a Florida resident, so make the most of it!