Greetings! Today, I want to chat about something that’s been on my mind lately: SIM swap fraud. It’s a topic that’s been making waves, and for good reason. It’s not just a tech issue; it’s a real-life problem affecting real people. So, grab a seat, and let’s break it down together.

What is SIM Swap Fraud?

SIM swap fraud is a sneaky type of identity theft. Essentially, it happens when someone tricks your mobile carrier into transferring your phone number to a new SIM card.

Once they have control of your number, they can wreak all sorts of havoc. Think about it: so many of our accounts are linked to our phone numbers.

From banking to social media, your phone number is like a master key. Essentially, SIM swap fraud is a sneaky type of identity theft that can have devastating consequences, as detailed in this SIM swap fraud lawsuit overview.

How Does It Happen?

Imagine this – you’re going about your day, minding your own business, when suddenly you realize something’s not quite right. Your phone’s not working, your accounts are acting up, and you just can’t figure out what’s going on. Well, the unfortunate truth is, you might have fallen victim to a sneaky little scheme called a SIM swap.

It usually starts with the fraudster doing a bit of detective work. They’ll gather up all sorts of information about you – your name, your phone number, maybe even some personal details. With that intel, they’re able to convince your mobile provider that they’re actually you. They might use phishing scams, fake websites, or even just a good old-fashioned phone call to get what they need.

And once they’ve got that information, it’s game over. They contact your provider and request a SIM swap, which means they basically transfer your phone number to their own device. Just like that, they’ve got access to your calls, your texts, and any accounts that are linked to your number. It’s a real invasion of your privacy and security.

Now, I know this all might sound a little daunting, but the good news is there are ways to protect yourself. Stay vigilant, be wary of any suspicious activity, and make sure your mobile provider has tight security measures in place.

The Real-World Impact

Those SIM swap fraud stories can really tug at the heartstrings. It’s such a cruel thing to have your financial security and digital life turned upside down like that. I can only imagine the gut-wrenching feeling of waking up to a drained bank account or being locked out of your crucial online accounts.

And you’re absolutely right – it’s not just about the money. The stress and hassle of trying to untangle that mess must be overwhelming. I’ve heard tales of people losing access to their businesses, their memories, their digital identities. It’s a real nightmare scenario.

These stories really underscore the importance of safeguarding our online accounts and financial information. It’s a sobering wake-up call that we need to be vigilant, to protect ourselves as best we can. But even then, there’s only so much we can do against cunning fraudsters. It’s a tough, unsettling reality we have to grapple with these days.

How to Protect Yourself

Now, let’s talk about what we can do to protect ourselves from this kind of fraud. There are a few steps you can take to make it harder for fraudsters to target you.

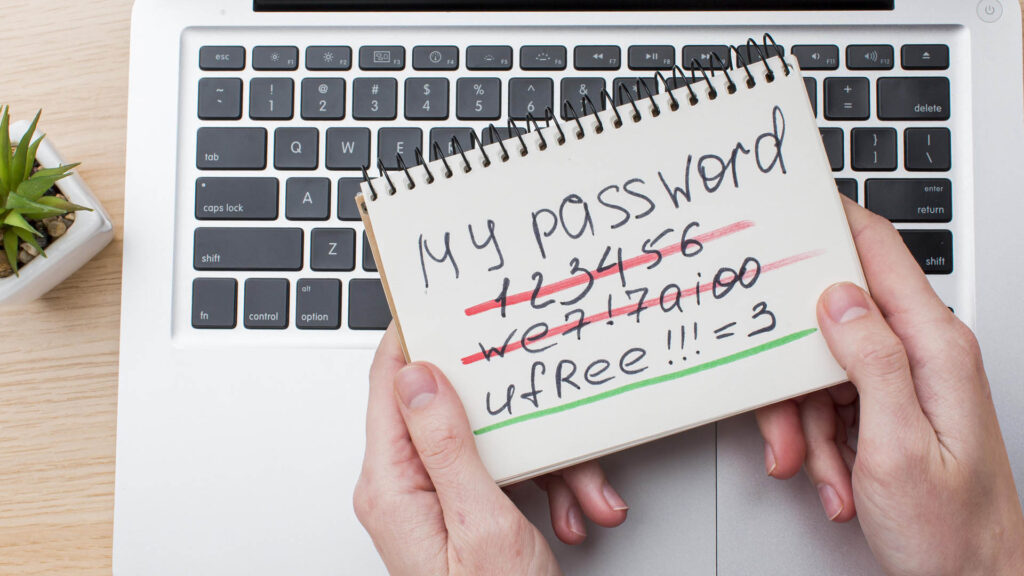

1. Use Strong, Unique Passwords

First off, make sure you’re using strong, unique passwords for all your accounts. I know it’s tempting to reuse the same password everywhere, but that makes it easier for fraudsters to get in.

2. Enable Two-Factor Authentication

Another important step is to enable two-factor authentication (2FA) wherever possible. This adds an extra layer of security by requiring a second form of verification, like a text message or an authentication app.

3. Be Cautious with Personal Information

Be cautious about sharing personal information online. Fraudsters can use details from social media profiles to build a convincing case when they’re trying to impersonate you.

4. Monitor Your Accounts

Regularly monitor your accounts for any unusual activity. If you notice anything suspicious, contact your bank or service provider immediately.

5. Contact Your Mobile Carrier

Finally, contact your mobile carrier and ask about additional security measures. Some carriers offer PINs or passwords that can be added to your account for extra protection.

What to Do If You’re a Victim

If you do fall victim to SIM swap fraud, it’s important to act quickly. Here are some steps you can take:

- Contact Your Mobile Carrier: Let them know what’s happened and ask them to reverse the SIM swap.

- Change Your Passwords: Update the passwords for any accounts linked to your phone number.

- Enable 2FA: If you haven’t already, enable two-factor authentication on your accounts.

- Monitor Your Accounts: Keep an eye on your bank and other accounts for any unusual activity.

- Report the Fraud: Report the fraud to your bank, the police, and any other relevant authorities.

The Role of Mobile Carriers

While we can take steps to protect ourselves, mobile carriers also have a crucial role to play in preventing SIM swap fraud. They need to implement stronger security measures and be more vigilant when processing SIM swap requests. Some carriers have already started to do this, but there’s still a long way to go.

The Future of SIM Swap Fraud

As technology continues to evolve, so do the tactics of fraudsters. It’s likely that SIM swap fraud will continue to be an issue for the foreseeable future. However, by staying informed and taking proactive steps to protect ourselves, we can reduce the risk and minimize the impact.

Final Thoughts

SIM swap fraud is a serious issue that can have devastating consequences. But by being aware of the risks and taking steps to protect ourselves, we can make it harder for fraudsters to succeed. Stay vigilant, stay informed, and take control of your digital security. After all, it’s better to be safe than sorry.

Thanks for reading, and take care out there!