Every employee deserves to get a pay stub with a monthly wage. The employer issues this document to keep track of the employee’s data. It is the perfect way to know how many hours an employee works and how much money the company should pay to the staff. The layout of the pay stub can be different in many places, but the information included in the document remains the same.

If you are doing your first job, you do not know much about the paycheck you will receive after a month of your service. Before you question anything about your salary, you must go through the document very well. Check all the stuff mentioned in the pay stub and compare whether the data is matching with your records.

The information mentioned in the stub helps clear all the doubts in employees’ minds and helps them know their work status. They will get money for the total number of hours they dedicate to the company. In the following write-up, we will discuss the information that is included in the employee pay stub.

1. Payment Date and Period

It is the exact date when the employee gets his monthly wage. The period mentioned in the document is the time length covered at the date of payment. You can understand by a simple example.

The starting date of the payment period is 1st January 2020 and the ending payment period is 31st January. The date of getting the salary is 15th January 2020. These dates must be mentioned in the document according to the rules.

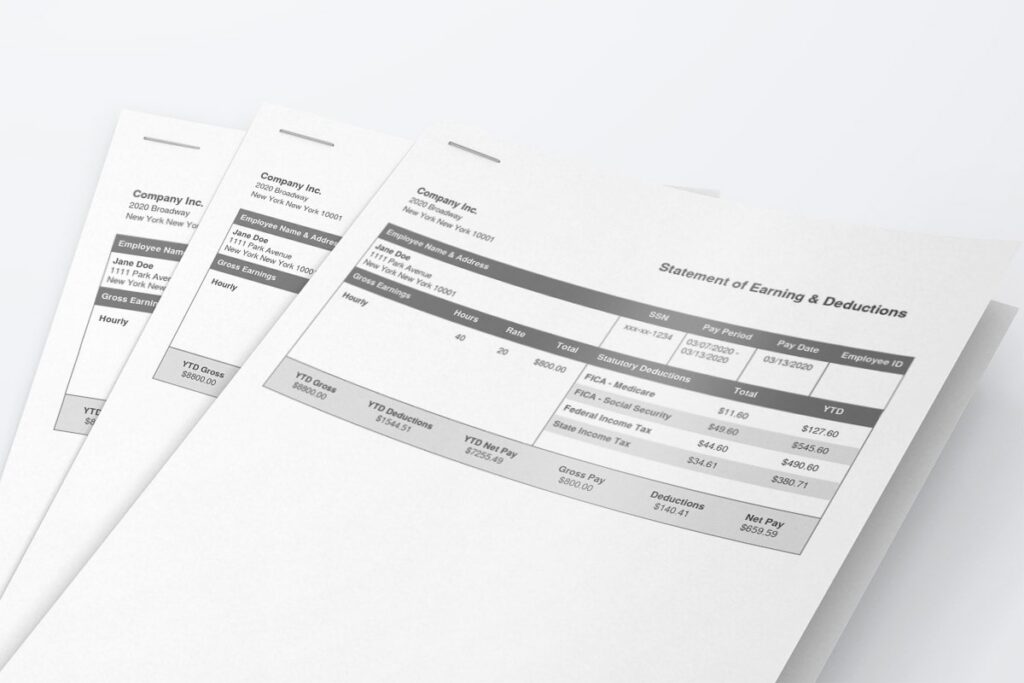

2. Gross Wages

It includes the entire payment that will be paid to the employee for the work that he must get done within the payment period dates. There will be no deductions in the amount, and it will be the exact monthly wage of your company’s staff.

Several other things are also included in the gross wage, i.e., your salary, holiday payments, additional money for overtime, incentives, commissions, etc. Without any deduction, you will know the exact amount that one must get after the month of service.

3. Worked Hours

An employee will get the salary for the number of hours he worked. You can hire the staff on an hourly or salary basis. But you have to mention such a thing in the document. The amount the company will pay you for a month will be mentioned in the document. The number of days will be counted in the given period, and your total salary will be calculated after making deductions.

4. Pay Rate

A company can hire any person in two ways. It can either be on an hourly or salary basis. If non-exempt salaried employees work for a number of hours than usual, they will be paid extra. The employee will get extra money for the additional hours he worked.

But in the case of exempt salaried staff, only the gross amount will be mentioned in the stub. The staff cannot provide overtime services to the company. They will not get extra money.

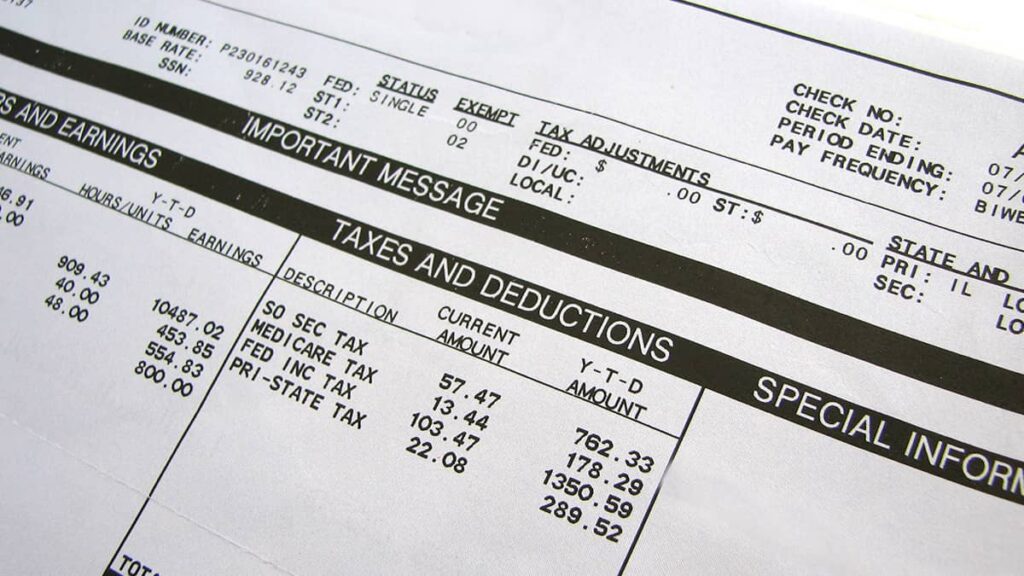

5. Pre and Post Tax Deductions

It is necessary to pay tax to the government, and the amount is different for everyone. The tax will be deducted and mentioned on the document. The tax deduction section should be separate so that the employee can understand how much money he will not get in his salary. It is crucial to pay the tax to the government to avoid future penalties. Many companies deduct taxes and pay them to the government.

6. Taxable Wages

All the above-average salaries are taxable, and some amount will be deducted from your gross salary. The stub does not involve anything regarding the after-tax deductions. The subtracted amount will be mentioned in your paystubs.

7. Year-to-Date Deductions and Wages

The total amount of year-to-date is the total earnings of any employee in a company. The staff can note all the deductions done in a year and how much they have earned yearly. Employers can also use this information to track their staff performances and salary data. Based on the staff’s wages, the employees are judged in a company, and they even get promotions for their consistent performance.

8. Net Payment

After all the deductions, the net payment amount is calculated and mentioned in the pay stub. The exact amount is transferred to the employee’s account or handed over to him by cash. The entire additions and subtractions are mentioned in the document to evaluate the net pay.

There is no scope for any confusion when it comes to getting the salary from the employer. The net payment is written at the end of the document, and it looks like a document’s conclusion.

9. Adjustments in the Payment Check

In the case of adjustments in the salary or deductions, the employer mentions everything in that document. If anything is printed by mistake, the staff can also talk about adjustments and get the corrected document with the exact salary.

Anyone can get confused with the mentioned amount and how some amount is deducted from your paycheck. You are free to ask anything and get the necessary information from the employer. You can ask for the adjustments if they are necessary, and it can change your net pay.

Final Thoughts

Every employee has a right to get a pay stub to determine the detailed salary information. The company’s staff can work for more hours than usual. There can be several deductions like tax, leaves, etc. The paycheck is a necessary document to maintain the salary record of every employee in the company. The employer can also keep a check on the staff and judge their performance.

If you do not know about the paycheck and its information, you must go through all the mentioned details. Ensure that everything is listed in your document, and you must revise them to confirm that you are getting the right salary. In case of fault, you can ask for adjustments.