Payroll companies can help small business owners reduce their time on administration tasks. This saves them valuable time and allows them to focus on growing their businesses. Payroll systems can help you calculate hours worked, salaries, bonuses, commissions, sick leave, and more. They can also automate tax payments and filings.

Reduced Risk of Payroll Errors

Payroll is a critical operational function for small businesses. It requires careful planning, compliance with labor laws, and a timely process for handling employee payroll taxes.

Many business owners rely on software to handle these processes. However, running payroll can be time-consuming and complex even with this solution.

In addition, paying employees correctly is a legal obligation that can result in severe penalties. The IRS issues billions of dollars in payroll penalties every year.

This is especially true for small businesses with fewer than 20 employees, where the risk of payroll errors can be more significant.

One of the most common mistakes that can happen is paying an employee incorrectly or missing a payroll deadline. This can result in dissatisfied workers, poor morale, and even legal issues for the business.

Fortunately, full service payroll can reduce your risk of errors and help you comply with all federal, state, and local tax regulations. Its user-friendly interface, expert support, and comprehensive feature set make it an excellent choice for small business owners who want to streamline their payroll management processes.

Automated Processes

Payroll is an essential part of every business, and if it is processed correctly, it can benefit your bottom line. This is why it’s a good idea to implement an automated payroll system.

The best payroll services automate time-consuming processes, including calculating employee wages, preparing direct deposits, data entry, and filing taxes. They also ensure accuracy by performing quality assurance checks and storing information securely.

Some payroll services allow businesses to process payments at any frequency, paying independent contractors and other hourly employees whenever needed without paying extra for additional runs.

These services also calculate tax withholdings and make deductions for benefits such as retirement savings. They can help small business owners avoid penalties by reminding them of critical deadlines. They also help ensure that employees are paid accurately and that their taxes comply with state and federal laws.

Time Tracking Features

Payroll is one of the most significant expenses a small business has to manage, and it can be overwhelming and time-consuming to handle. Fortunately, complete-service solutions provide a lot of benefits for small businesses. A good payroll solution will automate the process and ensure that all employees are paid correctly, on time, and in the correct amount to avoid costly penalties and taxes. They also help keep track of employee hours and overtime.

The system will input banking information for each employee, then deposit wages into their bank account and calculate taxes automatically. They will also generate tax documents like W-2s and file these taxes for you, ensuring that you comply with all current tax laws.

The best payroll services will also include features specific to your industry, such as compensation administration and reporting. These can help you administer bonus programs and adjust the minimum wage as required. They can also help you keep track of employee tips and vacation pay. These features can save your company a great deal of money.

Reduced Labor Costs

Paying your employees and contractors accurately and on time is a top priority for small business owners. However, the task can be a tedious and time-consuming endeavor. Thankfully, there are a few options to help you out.

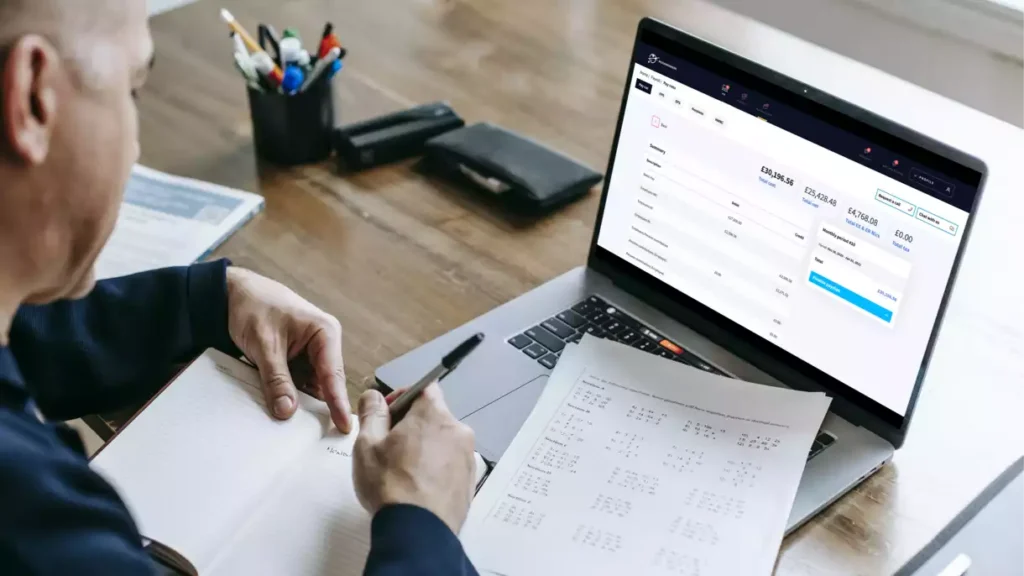

Complete service payroll solutions like Paychex provide comprehensive services that allow you to manage your entire payroll from a central location. They also offer features to keep payroll compliant with the IRS and state governments. They even have a labor cost tool that can help you track your expenses and allocate your labor more efficiently in the future.

The cost of a top-of-the-line small business payroll solution is typically a fraction of the expense you would incur if you hired a dedicated employee to handle your payroll needs. Depending on your specific needs and budget, you can get a quality service for as little as a few hundred dollars monthly. The best way to determine which service is exemplary for your company is to schedule a free demo or try the software using their free trial offer.

Increased Efficiency

Payroll is one of the most time-consuming tasks a small business can do. It can also lead to errors that cost the company time and money.

Rather than relying on manual processes, businesses take all the work out of running payroll. They do everything from processing employee payroll to printing checks and direct deposit to filing taxes.

Many of these services even offer human resource support and year-end tax reporting. This helps save time and reduces the risk of compliance issues or IRS audits that could cost the business money.

Some providers offer fixed-rate monthly pricing, while others charge based on how many employees they process each month. Both models work well for small businesses, but you should determine which fits your needs best.

The benefits of full-service payroll can significantly affect your organization’s efficiency. These benefits can help you get paid faster, save time and money, and improve employee satisfaction. This makes it a smart choice for any small business looking to grow and improve.